Sakhalin 2 (2008-2009)

Key information:

- Phase 2 «Sakhalin-2» (LNG plant, 9.6 million tons per year)

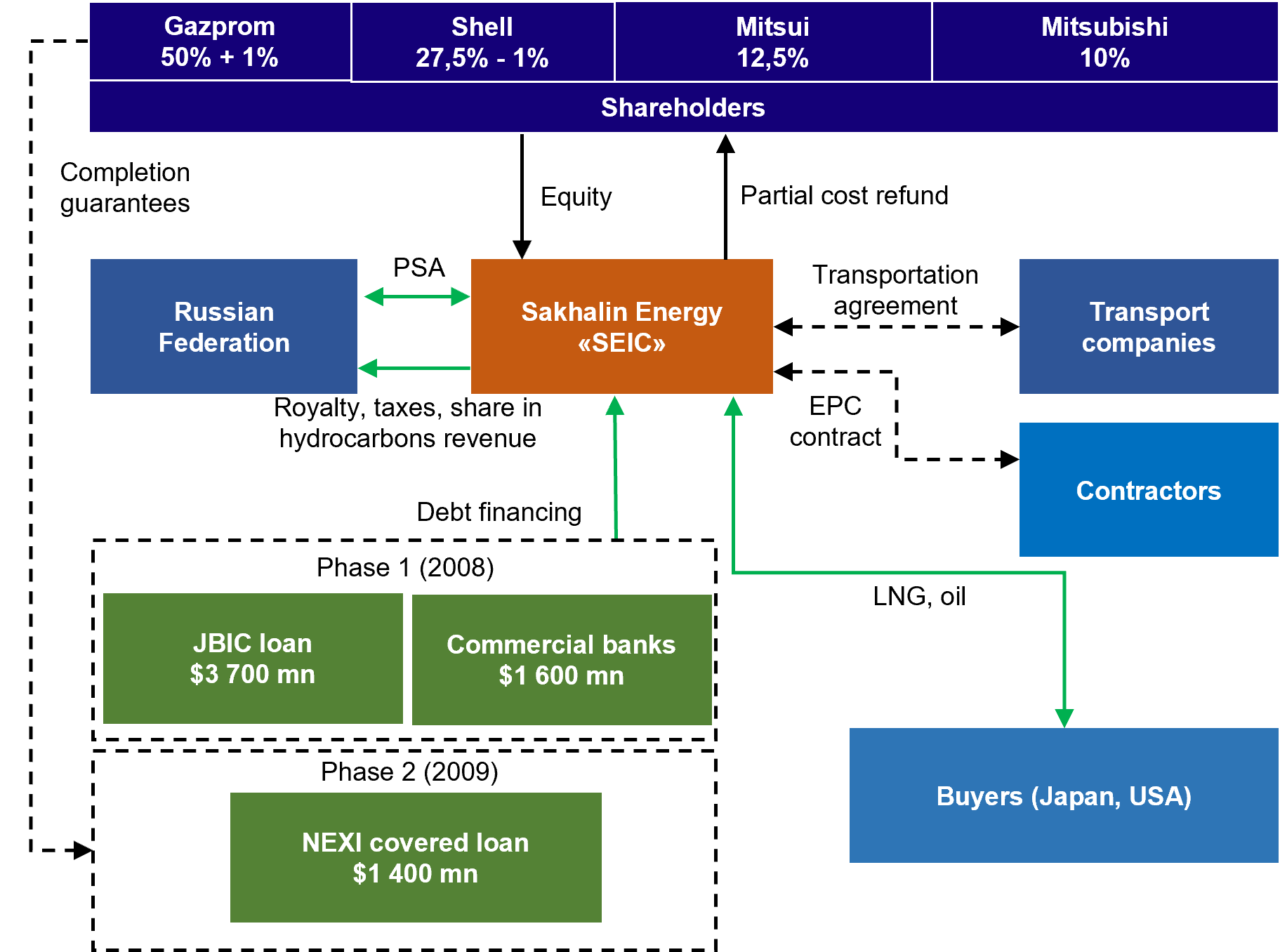

- Sponsors: Gazprom, Shell, Mitsui and Mitsubishi

- Financial consultants: SEIC, Credit Suisse

- Gazprom financial advisors: Gazprombank, RPFB

- Debt $6.7 bln (Tranche 1 – $5.3 bln in 2008, Tranche 2 $1.4 bln in 2009)

- Creditors: JBIC/NEXI, international banks

Organizational and financing features:

- Untied Government Funding (Japan) – natural resource import support program

- Structuring relationships with partners

- Purchase – sale agreements

- Attracting additional sources of financing

- Analysis and optimization of financing sources

- Untied Funding from ECA

- Structuring project finance in the PSA regime

- Assistance to creditors under the control program – preparation and revision of the «Base Scenario» for banks

- Share purchase agreements, World Bank negative pledge

- Preparation of project bond issue for additional financing (2011-2014, cancelled at an advanced stage)

Sakhalin 2 – financing structure